half-off finally sells 620 Broadway artist loft with (obviously) some issues

how selling a Manhattan loft can be like your worst experience pulling off a band-aid

I’m going to lead the way you should pull off a band-aid, quickly (brutally, even): contrary to what you’ll read on StreetEasy, the very quirky duplexed ground floor artist loft on the 1st floor at 620 Broadway that sold for $2.425mm on March 12 started its (true) listing life on July 3 last year asking $4.895mm. No matter how quickly you pull, a lot of skin is going to come off in an experience like that. That’s 49.54% off the original asking price for you overly precise folks, “half off” for the rest of us. I’m not even going to look at my Master List of downtown Manhattan loft sales before saying that no loft has sold in a long time that started asking double what the market would pay.

Here’s the actual listing history taken from the inter-firm data-base:

| July 3, 2014 | new to market | $4.895mm |

| Aug 13 | $4.195mm | |

| Sept 17 | $3.55mm | |

| Oct 7 | $2.999mm | |

| Oct 22 | $2.8mm | |

| Jan 24, 2015* | contract | |

| Mar 12 | sold | $2.425mm |

(*It’s possible that the StreetEasy contract date of December 29 is correct; the StreetEasy feed is clearly missing the first date [it starts with “Price decreased by 14%”] and it has that peculiar December price increase, which couldn’t possibly have happened in real life.)

Wrong though they were, the sellers were aggressive about finding the market. You don’t often see a $700,000 drop in six weeks, let alone one followed by a $600,000 drop in another five weeks, and I’m going to simply assert that you never then see a $500,000 drop within three weeks. Or, as StreetEasy shows you the math, drops of 14%, 15% and 16% in three months. Again, I’m simply going to assert that in any prior cases of huge price cuts needed to find a clearing price, sellers tend to take much longer to make the necessary adjustments.

From a spectator’s perspective (Manhattan residential real estate can be a brutal sport to watch) that’s breathtaking. From a seller’s perspective?? There are no words.

did I mention there are ‘issues’?

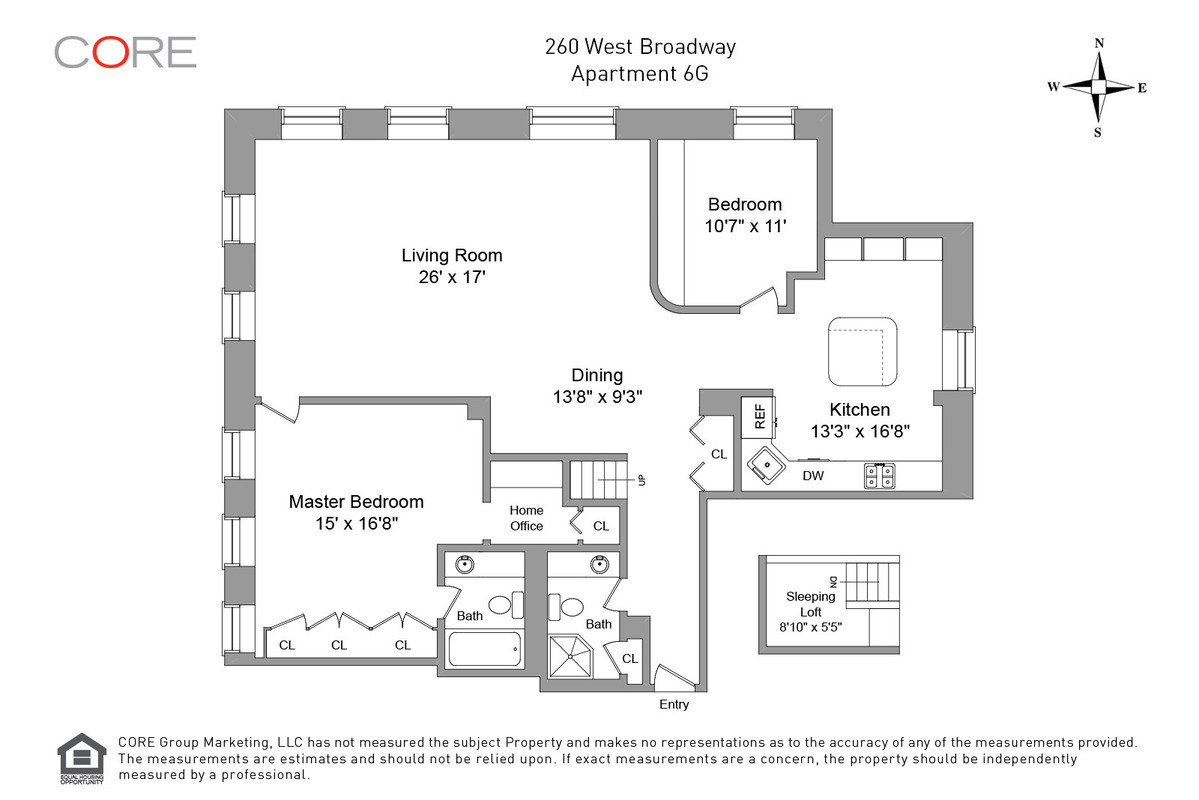

The broker babble includes a great deal of lemonade, with the loft described as “dramatic”, “[s]uperbly positioned”, a “perfectly preserved artists’ live/work loft” with “many great features and possibilities”, “soaring 15 ft ceilings, incredible wall space for displaying artwork, and hardwood floors”, a floor plan that “was thoughtfully conceived”, “ample light but also privacy and quiet enjoyment”, plus “an abundance of storage space and … a multitude of uses”. All this is true enough, as is all good babbling, but let’s start with the floor plan:

the middle is the main (ground floor) space, with the gallery + “bedroom” downstairs on the left, and the paired mezzanines (with their “abundance of uses”) on the right

It’s an unusual floor plan, with the three levels and cut-aways (“open to above” or “open to below”). The view from the west end of the ground floor level gives the best sense of how the space flows:

you’re standing in the mezzanine above the entrance, looking over the kitchen and LR (15 foot ceilings!) toward the wall of glass bricks facing quiet and private Crosby Street, some 75 ft away

(It took me a few glances to recognize that white box just off the corner of the kitchen as the spiral stairway down to the gallery, one of three spirals from the ground floor.)

From this vantage point, you are looking toward the light, in the sense of “the” light, as in the only light. In other words, there are no windows, but

a wall of glass bricks … runs seamlessly through both floors as well as the mezzanine level allowing for ample light but also privacy and quiet enjoyment.

That’s a pretty important wall of glass, isn’t it? You’ll never have a sense of the outside world from this loft, other than knowing whether it is dark outside, or light. That’s rather … challenging.

what’s with all the sleeping with tubs from back in the day??

There’s a hint in the floor plan that the huge master suite is for more than sleeping, which is confirmed in this photo:

watch your partner bathe!

Since this is a “perfectly preserved artists’ live/work loft”, I assume that rather large jacuzzi at the foot of the bed dates from the 1980s, at least. Presumably, this entire loft will be gutted, including the mezzanines, and the lines redrawn where the new owners want them. They are not likely to leave a combined bedroom plus bathing room, but they do have that option. Since there’s no making lemonade in the babble about the plumbing finishes, the implication is that kitchen and baths are all rather … (how to put this delicately?) … dated. But we know that there are at least two sets of plumbing stacks to work with, that front one by the entry on the main floor (which doesn’t look bad in a listing photo) and this one down below grade where the master bath is split into that open jacuzzi and a private room for sink and toilet, backing up on a sink accessed from the art gallery.

This bed + bath set up is reminiscent of the more sleek one (which is likely to be preserved in some manner by new owners) that I hit in my March 15, how much did the bathtub cost this Chelsea loft at 151 West 28 Street?. Like this Noho loft, that Flower District loft was optimized for an individual or couple, with a single sleep area that lacked windows but was open to the bathtub. And also probably dating from the 1980s. Like that Noho bathing experience, anyone using the Noho bathtub would know that the sounds of the bath would filter through the entire loft.

an artist’s loft for display rather than creation turns into house money

The babble sent me to The Google to learn about the “world renowned New York artist” who lived here. She made large metal sculptures over a great many years, but there’s no evidence that she made them in this loft. The lower level of the loft was her sleeping (and bathing!) area, shared with the art gallery evident in this photo:

a well lighted gallery, but by Con Ed, with no sign of manufacturing or creation space or equipment

The deed record indicates that the formal seller was the deceased artist’s estate, represented by her son (and daughter-in-law?). I wonder how many beneficiaries there were, and whether the executors felt pressured by others. Remember: they got $2.425mm for a loft that was brought to market at twice that price. And that immediate sequence of major price drops is certainly consistent with somebody saying to someone else “we tried your [ridiculous] price and it didn’t work, so let’s drop and drop until we hit a buyer zone.” Or so I can easily imagine.

No idea whether this loft was a major piece of the estate’s value, of course, but an estate sale is often a situation of playing with house money. Beneficiaries can be tempted by visions of zeroes dancing through their heads, but the longer the property is over-priced the longer it will take for them to put cash in their pockets. In this case, they asked a series of dramatically too-high prices, but only took six or seven months to get into contract. So they didn’t waste a lot of time proving how wrong that original price was.

only for data integrity nerds…

Careful users of StreetEasy will have noted that the listing is for loft “#1F” and the deed record for “#1R”, and that StreetEasy does not match them up. There’s no doubt that they are one and the same loft, and little doubt that the loft is in the Rear of 620 Broadway rather than the Front. And I am pretty sure that the main level is at ground level with the lower level below grade (on the west side of the building at least). I was worried that floor “1” might be a European first floor, but now I’m not. Bear with me for my explanation, or go on with your life.

First, the babble tells us that the glass brick wall at the east end of the loft is at Crosby Street, while the building photo on StreetEasy shows a retail store on the Broadway (front) end of the building; Property Shark and StreetEasy agree this is a 6-story building, with residential lofts on each floor “1” through “6”, and The Shark has the critical datum that the building is much longer than this artist loft, at 187 feet. So, I’d bet my standard quarter that one enters the “main level” of this loft by walking a long way from the Broadway sidewalk residential entrance past the David Z store, with the lower level … below (d’oh). (Note to self: check to see if Crosby Street is downhill enough from Broadway for this 187 foot building to have a two-level glass wall on the east [Crosby] end with light extending all the way to the bottom. That wall of glass should be pretty obvious from Crosby Street.)

Anyway, I have no idea why this loft would ever be called “#1F”, but that surely (a) is wrong, if “F” means the conventional “front”, and (b) confuses StreetEasy. I hate when that happens. And that confusion happens all too often with residential Manhattan lofts, usually when a deed record and listing disagree about whether a given loft is, for example, “#5” or “5th”. Stupid stuff like that can confuse StreetEasy.

I hate stupid stuff, especially needlessly stupid stuff. End of rant. Resume normal activity….

Follow Us!