open eastern view is worth $425,000 at Chelsea Mercantile (approx) (at least)

minus the office, plus 12 floors of iconic Manhattan loft

Few downtown Manhattan residential loft conversions have provided as much grist for the Manhattan Loft Guy mill as ‘The Merc’ aka Chelsea Mercantile aka 252 Seventh Avenue. It is, in my judgment, the building that ‘made’ the immediate micro-nabe a destination for ‘uptown’ buyers around the turn of the century, and it is a huge building (for a loft), generating opportunities to comp within the building on things like light and view. The Google will help you determine exactly how many times I’ve taken readers there in nine years, but it’s a lot! We return today because the month-old sale of the “1,652 sq ft” loft #4U at The Merc is a good jumping off point for discussion of higher floors, greater utility, and a view (even an unremarkable view).

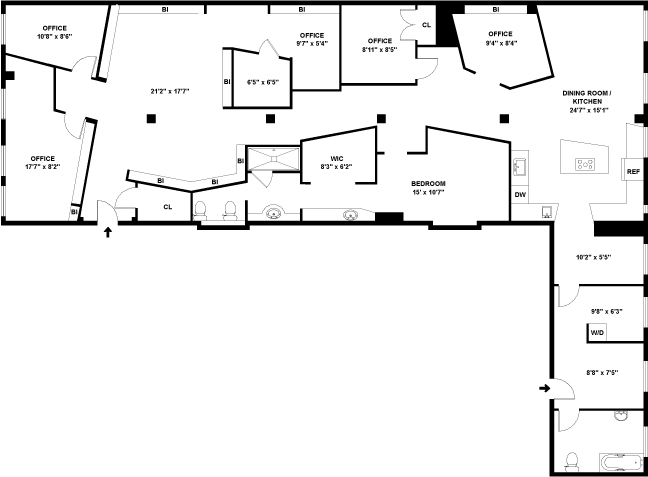

The loft is a bit of a value play in this amenity-filled condominium building, though any ‘value play’ here is relative. The broker babble presents as though the original (nice!) finishes have not been upgraded since 2000; its on a low floor, with ‘views’ of the neighbors across 24th Street; there’s but that single exposure, with six windows spread among the living room and two bedrooms; its got the utility of a third sleeping area, but that’s an internal office (‘study’). Net-net, if there are any bargains at 252 Seventh Avenue, this should be one of them.

pretty basic, nothing special

The Market treated it as though it were a bargain, acting quickly and adding a dash of premium: to market on October 20 at $2.85mm, in contract at $2.9mm by November 17, and closed on January 20. That’s $1,755/ft of ‘bargain’ in the most high-amenity loft condo in the micro-nabe.

meanwhile, on the 16th floor…

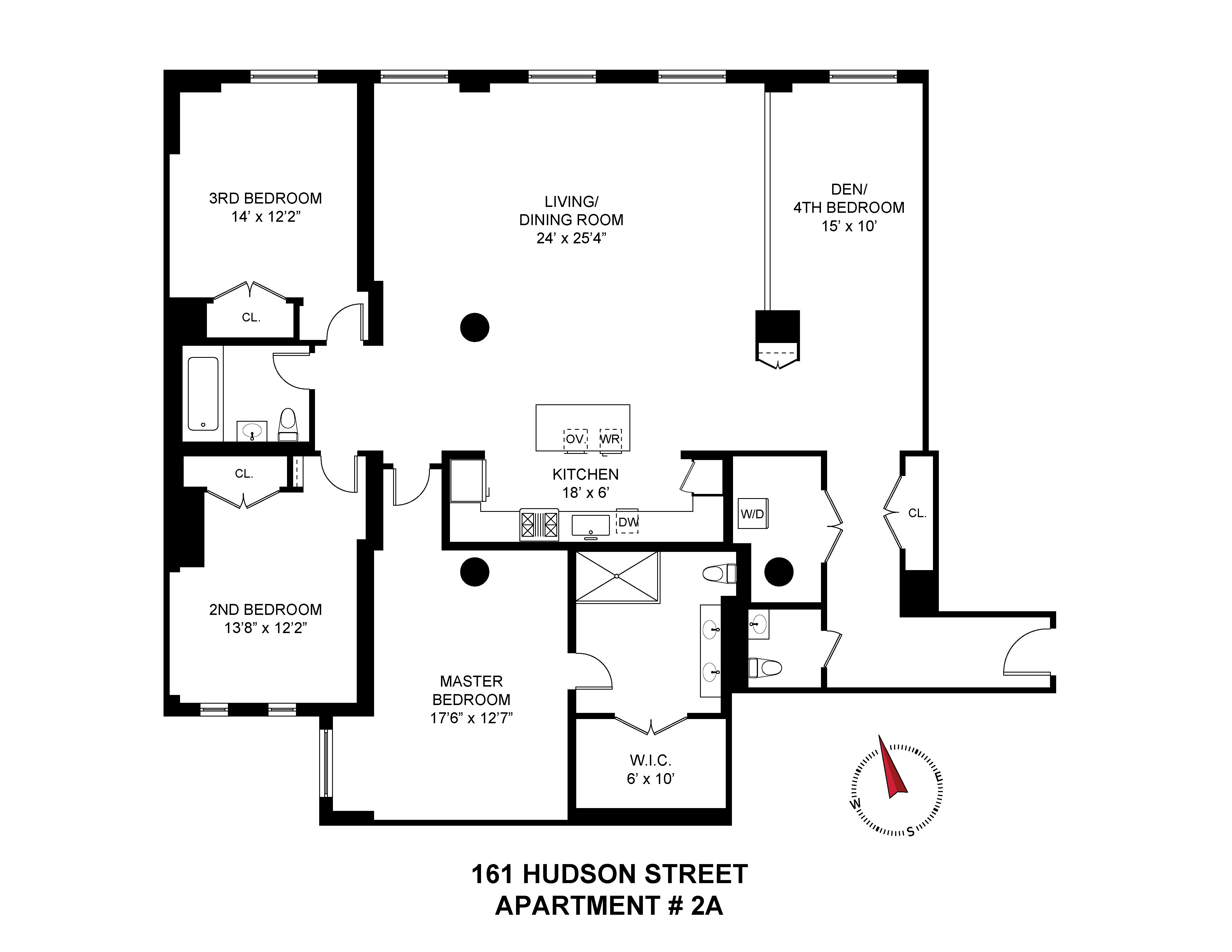

Loft #4U directly competed (briefly) with the “1,601 sq ft” loft #16L, which was also babbled as though it has not been improved since 2000 (not that there’s anything wrong with that!). Though nearly the same size, and with similar shape, the upstairs loft lacks that study that #4U has:

again, pretty basic, nothing special (on paper) (and why oh why does Rutenberg make it so hard to find the floor plan??)

These lofts did not sell ‘on paper’, of course. In real life, loft #16L has a significant feature not shared with #4U: “Eastern facing open city views from every room”. (Why oh why don’t the listing photos make this more easily seen?)

The #16L sellers thought the loft and views and light would be more valuable than they turned out to be, but there’s still big gap between these two lofts. Loft #16L came to market at $3.65mm on August 27 and lingered long enough for #4U to join the party, not finding a contract until November 12 at $3.325mm, and closing quickly on December 18. That’s $2,077/ft, or a premium of 18% over #4U on a dollar-per-foot basis, $425,000 in actual dollars.

These are not perfect comps for each other, of course, because #4U’s study makes it suitable for buyers who had to have something more than two bedrooms. (Remember: #4U is a [relative!] bargain here.) I’m not going to appear to be rigorous about the additional value of that extra (interior) room in #4U, but its got to be six figures, if not in the ballpark of the quarter million bucks a simple room size X $1,755/ft yields.

Which is a long way around to getting to the headline: those open eastern views in #16L added significant market value in this building-specific hyper-local market, at least in October and November, compared to no views on the 4th floor. At least $425,000, but more likely at least $525,000, and possibly $700,000. Note that the #16L ‘views’ are simply of open sky; even at this height, there seem to be no brag-worthy icons visible from those windows in this direction.

Three years ago I meandered through a few sales in this building that were quite relevant to the value of ‘iconic’ views in that long-ago market. In my January 20, 2012, privileged Chelsea Mercantile loft clears near $1,700/ft at 252 Seventh Avenue, I featured a 17th floor north view that would ballpark in the same market in which #4U and #16L just sold at about $2,206/ft (using the 30% intervening gain in the overall Manhattan residential real estate market, as summarized in the StreetEasy Manhattan Condo Index, of course).

That’s a smaller premium for an ‘iconic’ north view over the (merely) ‘open’ east view in #16L ($2,2207/ft over $2,077/ft, to save you the scrolling) than I would have guessed, but it ain’t nuthin’. And it is broadly consistent with the July sale of the iconic north views of loft #16G at $2,212/ft (the time adjustment would only be 2% on top of that).

I’m not going to plumb the building stats further on this occasion, but if you have access to the closed sales prices on StreetEasy, knock yourself out! As I said three years ago:

If there is a data geek out there looking for a laboratory to explore the value of views, one could do worse than start at the Chelsea Mercantile at 252 Seventh Avenue. The Merc is an unusually large building for a Manhattan loft conversion with well over 300 units where there is a very active market and a wide variety of views. Low floor units look at buildings across the street or into the courtyard, and even many higher floor units have compromised views.

Next time some Know It All at a cocktail party starts talking about the value of Manhattan views, throw some Chelsea Mercantile data points at her. Dazzle your friends!

Follow Us!