Tribeca loft sells up 45% in 19 months … a superstorm effect?

hard to find another explanation for such a beyond-market result …

When I get confused, I write. Not to end the confusion necessarily, but to seek peace. The sale four weeks ago of the “2,325 sq ft” Manhattan loft #2A at 161 Hudson Street for $4.4mm confuses me, so you might want to refresh your afternoon coffee before continuing. It’s fascinating that a second floor no-view loft at the edge of the Holland Tunnel spillways got $1,892/ft, but that’s not confusing. It’s curious when owners hide columns in lofts, but hardly confusing. And it’s downright weird the way some folks decorate a powder room, but (again) not confusing.

Here’s what confuses me (YMMV): that the recent sellers bought this loft in July 2013, did a “meticulous renovation”, then put the thing up for sale 15 months later (how long after the renovation wrapped?). Oh, and the fact that they sold at $4.4mm what they paid $3.025mm for the right to renovate. And the right to resell. Which they did, and did, generating a 45% increase in value over the same period the overall Manhattan residential real estate market was up 16%. Let’s ballpark the value of loft #2A at the end of the year without the renovation at a conventional market gain, or about $3.5mm, leaving $900,000 worth of confusion for me.

Of course some of that ‘extra’ gain is from a renovation that The Market loved. Follow me into confusion, as we play Guess The Cost Of The Renovation….

comparing Before v. After through babble + pix has its limits

I saw the loft with clients before it sold in July 2013. There was noting ‘wrong’ with it, just not for them as there is not much light, and no view to speak of. View claims aside, that version of the broker babble seemed fair enough, including some brag-worthy things with my emphasis:

11″ ceilings, has a huge open kitchen with black granite countertop, cherry wood cabinetry and top of the line appliances. … There is central air and heating system with a built in humidifier. … Brazilian walnut floors throughout and Northern reflective light coming in from the super large windows looking onto Laight Street with a pleasant city view. You will see the large size Master bedroom with ensuite bathroom of honed marble and double sinks.

We found all the office usage distracting (the red column especially), but nothing that couldn’t be edited out.

The loft actually sold pretty quickly then, only seven weeks to contract, though they took their sweet time closing. As hinted in the headline, this loft came to market two weeks after The Superstorm That Had No Name In New York (because tropical storms don’t have names, dammit, and the former unfortunately named hurricane downgraded itself while battering New Jersey). And it sold a tiny bit above the ask:

| Nov 10, 2012 | new to market | $2.995mm |

| Dec 28 | contract | |

| July 3, 2013 | sold | $3.025mm |

The After loft sounds a lot like the Before version:

meticulously renovated throughout. … open chef’s kitchen equipped with vented Viking range, Subzero refrigerator, Marvel wine chiller, and white granite dining bar. The master suite has a sumptuous bathroom and generous walk-in closet, and all three bathrooms have been exquisitely crafted by California Faucets. Design details include 5 Brazilian walnut floors, a large laundry room with Electrolux washer/dryer, three honed original concrete pillars, several custom closets throughout, and central air conditioning

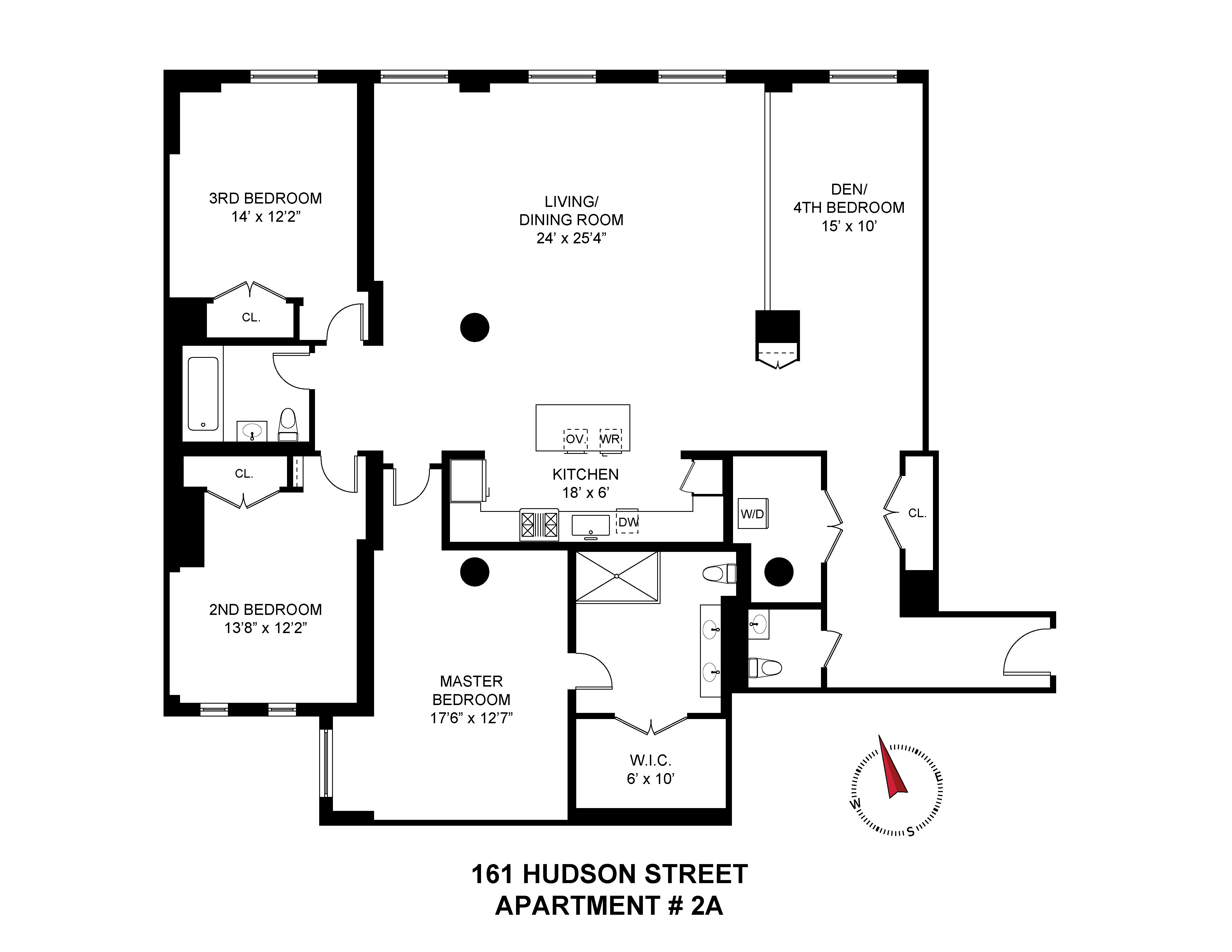

The After floor plan greatly resembles the Before version, with the principal change being changing the access to the washer dryer from the kitchen to the large entry closet:

no major changes in layout

Frankly, the changes seem to be more a matter of aesthetic upgrades than of dramatic improvements, but perhaps that is because I didn’t see After in real life. Which kitchen do you prefer?

nothing wrong with this kitchen, with black (granite) and red (including cherry) + top appliances

more muted (more sophisticated?) palette, with cabinets on the left instead of washer-dryer entry; appliances look the same

In other words, my impression was that the kitchen didn’t have to be redone in order to present as a lovely loft. Maybe the real money in the meticulous renovation went into the 2 and a half baths, none of which are pictured as Before but all of which are pictured in After.

I can’t decide if this (new?) powder room provokes more of a gasp than a smile

Net-net, the July-2013-buyers-turned-January-2015-sellers moved some closet walls and changed … er … meticulously renovated the kitchen and baths. Did they plan this as a fix-and-flip, or did their lives change between July 2013 and October 2014? Hard to believe someone would count on generating a positive return on the scale that they got, for whatever investment they made in that meticulous renovation, so much of which is invisible to the naked eye reviewing photos.

If this were an obviously gut renovation, I could see a renovation budget that could eat up much of the $900,000 in ‘extra’ gain from July 2013 to January 2015, but I don’t read the babble, floor plans, and photos that way. At all. Couple of hundred thousand for redoing the skin of all the plumbing rooms? Granted, that’s where money goes to die, but still … hard to see this as even $300,000.

Hence, my (continued) confusion. What made The Market value this (cosmetic set of?) change at such a premium over the fairly recent sale of (much) the same loft??

metaphysics can be more dismal than economics

One of the conundrums that involve same-loft paired sales that seem to involve an outlier result is that you can never be sure which of the paired sales is ‘off’ (assuming you are convinced that one is, of course). With loft #2A, the observed gain is too darn big, which cries out for explanation. In each case, the loft was professionally exposed to The Market by sellers who (I have to assume) did not have to sell; more confusingly, each time the loft sold above ask.

I take it as given that the observed market gain is a major outlier, and that the renovation (no matter how meticulous) accounts for only a small part of the observed gain. I am confounded that these facts are facts: $3.025mm purchase + renovation + 18 months = $4.4mm sale. (Not to get too nerdy on ya, but some of that is the relatively long time it took the loft to sell in 2013, six months instead of two or three, but that’s another logical element of too-small magnitude.)

small data sets can lead to conclusions of dubious validity

I see some hints in the other lofts sold in this small (24-unit) condo loft building that bracket the first sale in the pair that confounds me. Treat this more as thinking out loud than the path to The Answer….

The last similar loft to see in the building was the smaller at “2,117 sq ft” loft #7C, only 2-bedroom+den but with views, and a brag-worthy set of finishes. It went quickly at full ask of $3.6mm, closing in July 2014. Adjusting only for time in a comparison of #7C and #2A before renovation, the July 2013 purchase at $3.025mm bumps to about $3.5mm, as the StreetEasy Condo Index was up 17% in that 12 month period. On a price per foot basis that’s a time-adjusted #2A at $1,505/ft and actual #7C at $1,700/ft, not such a huge spread, one that could (conceivably) be bridged by the views … but I doubt it. And #2A is three real bedrooms.

Ignore #3A as a private sale, then gaze on the last sale before #2A in 2013: the “2,314 sq ft” #2B sold for $3.7mm on April 24, 2013. Same floor in the same building, also 3 bedrooms, but probably better dressed … still: $675,000 higher than #2A. Or, $1,599/ft in April, just before #2A went for $1,301/ft in July (the StreetEasy Condo Index was up 5% in those three months). hmmm …. I don’t see $300/ft in difference in finishes, though #2B is clearly nicer.

One more, then I’ll stop. The “2,317 sq ft” loft #5B sold 16 months before #2A, going for $3.325mm in April 2012. That one might have been nicer than #2A and benefitted from views at that height (and was “sun-drenched”). Adjusting that one forward in time to match #2A in July 2013, #5B bumps up to about $3.65mm (the Index was up 10% in between).

I don’t see $625,000 in value in the finishes, light and views at #5B over #2A. The Market did. hmmmm….

These are only a few data points, each requiring some adjustments. Adjusting anything introduces error, and serial adjustments, well, you know. But each of these data point in the same direction: that #2A when purchased in July 2013 was under-valued compared to itself (later) and three other units in the building (earlier, and later).

There may be no “why”. But I have to wonder if it had anything to do with That Anonymous Superstorm Too Easily Given The Name Of The Actual Hurricane That Spawned It. More precisely, to those sellers over-estimating the impact the storm (and powerless aftermath) would have on Tribeca values. Maybe they were in a very thin market at that time, and The Market didn’t give them enough buyer interest to correct a too-low ask, except by the $30,000 ‘premium’ they got. Maybe they just wanted to ‘get out’. Dunno.

Obviously, I’m confused about this. If you know something, comments are below….

Follow Us!