NY Times finds a Broadway chanteuse who loves her Tribeca loft

things Manhattan Loft Guy loves … include loft lovers

When the New York Times real estate feature “What I Love” works for me, it stars a celebrity who talks about her home (OK, her loft) and not just her stuff. This past weekend’s Judy Kuhn, ‘Fun Home’ Star, on Her TriBeCa Loft from the Sunday Real Estate section, fits the bill nicely. I don’t know the subject, but Kuhn’s appreciation for her “3,000 sq ft” loft and her neighborhood (Tribeca) is infectious. And it happens that I do know her loft (at least, others in the building).

Let her tell her story. I guess she wasn’t yet a Broadway star when she moved to a “small” loft on Varick Street with her then-boyfriend and now husband in 1989. I can relate, as we had the same experience moving from a small Upper West Side apartment to (what seemed like a huge Tribeca loft) in 1981:

“Friends asked, ‘Do they have grocery stores down there? Do the subways go down there?’”

When even her four-year old realized that Varick Street loft was too small for them, they had to move. In 1999,

They looked for a long time, just about losing hope that they could afford to stay in the neighborhood.

I can relate, except that when it happened to me in 1993, we looked at every loft in Tribeca of 2,000 sq ft or more (including possible combinations), but it didn’t work out, so we moved to a 2,200 sq ft loft about 30 blocks north. For Kuhn & Co. it worked out well, when a coop board with a second floor loft to sell that had formerly been commercial space preferred them, as native Tribecans, to other interested buyers:

What they moved into was a raw space with 13-foot ceilings, iron columns and, thanks to a row of windows front and back, loads of light. Guided by an architect friend, Nate McBride, they pulled up the carpet, exposing beautiful, if splintery, pine floors, yanked layers of industrial felt off the walls, then paved over much of the Sheetrock with narrow white boards to add interest.

(I wonder if her coop took ownership of the commercial loft after some sponsor litigation, as happened to my loft coop in 1993; when the market changed, we got the 2nd floor rezoned from commercial to residential and sold it … but I digress.)

Is it possible to be both relaxed and stressed by the same opportunity? In some sense, Kuhn took a relaxed view to renovating (and decorating) from 1999, onwards, though she describes it differently:

“I think there’s something about renovating a loft,” Ms. Kuhn said. “It takes so much work and so much thought, down to picking doorknobs and lights, which is so hard and stressful, and can test a marriage. And then you move in and live here for a while, and you figure you’ll deal with the fixtures later. And years go by, and you get used to the space just the way it is.”

Of course, nowadays people tend to buy primitive lofts to fix up right away, getting the messy stuff (and the expense) out of the way up front. Back in the day, lots of people did the same buy-and-move-in-and-figure-it-out-later thing. Kuhn & Co. were blessed with a flexible footprint (more on that, anon) and bountiful space:

The sheer expanse overwhelmed the couple with possibilities. They knew they wanted to hold onto the apartment’s sense of openness, but that was all they knew. “Because the loft is so wide, we went through different versions of a layout where we thought of having the kitchen over here and then over there and over there,” Ms. Kuhn said, pointing around the space. “And our architect kept making different models and showing us all the options.”

No putting on airs for them, and no hired decorator (despite having hired that “architect friend”):

Furnishing the loft has been a cheerfully extemporaneous business involving antiques shopping (for pieces like the glass-topped wrought-iron table in the designated living room), flea markets (for the schoolroom chairs around the barn-board dining table) and the kindness of friends (the couple inherited a pair of sofas, a coffee table and a rug from someone moving to San Francisco).

Click the accompanying Slideshow to see what they’ve done with the loft, and how broadly she smiles for the camera in it. Photo #2 gives a great sense of those “beautiful, if splintery, pine floors”, the high ceilings, the iron columns, and massive wood beams (I hate it when they leave out massive wood beams in listing the primitive charms of a loft). That photo also gives the best sense of the “sheer expanse” of the loft, which gave them so many choices about layout.

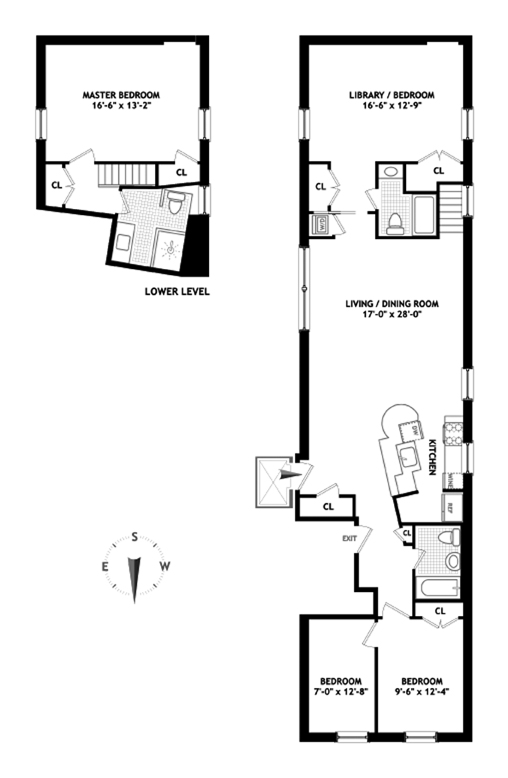

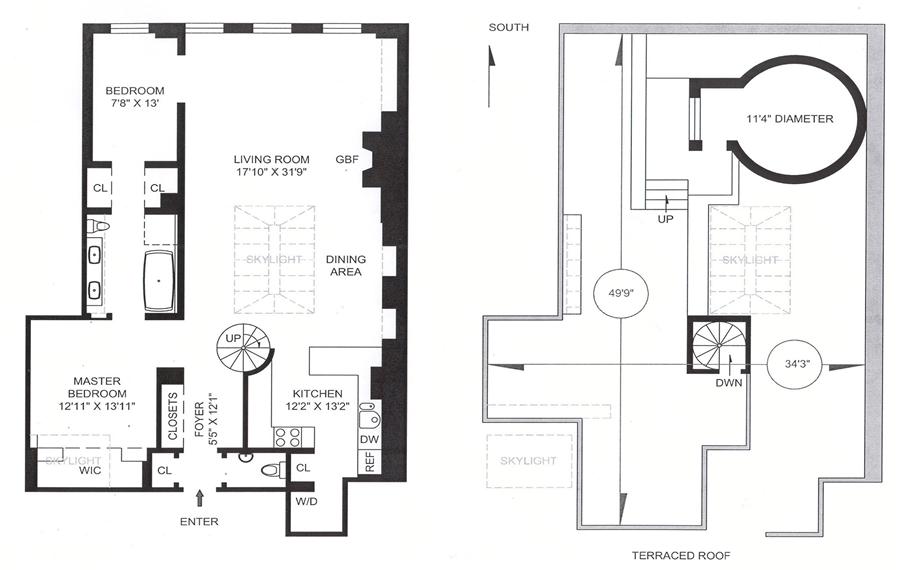

This is not the floor plan of her loft, but the footprint will be the same because this is the loft directly above:

that 2nd Slideshow pic is looking south (here, up) from near the elevator; the window walls are about 50 feet apart there (of course, her second floor is laid out completely differently)

That’s the floor plan from when the 3rd floor was marketed as a not-really-combined renovation project heading into The Quarter Formerly Known As The Peak.

the project the neighbors bought in 2008 for $1,219/ft

Way back when I used to blog about still-for-sale lofts, my December 22, 2007, 149 Franklin contract / from Halloween to Christmas, noted that I had missed the “3,150 sq ft” 3rd floor loft when it was an active listing, but caught it when it went into contract quickly. This is what the 3rd floor looked like, before renovation, with open joists and some sort of polished floor:

same windows, same columns + beams, but doesn’t look much like the 2nd floor loft

(The photo is taken from the Corcoran listing; all StreetEasy has from that listing is confirmation of the sales price, $3.84mm on March 31, 2008, and a death loop of links, none of which lead to that listing.)

I loved the possibilities in that footprint. From my December 22, 2007 post:

The layout just screams 2 combined units that are not very combined, with 2 kitchens that are too far apart to be kosher and only 2 points at which one can go from one ‘side’ to the ‘other’ (doorways, not integrated spaces). I assume a buyer will take on the challenge of integrating this large space. It is actually a terrifically flexible footprint, not quite square, with long runs of windows on the two longest sides.

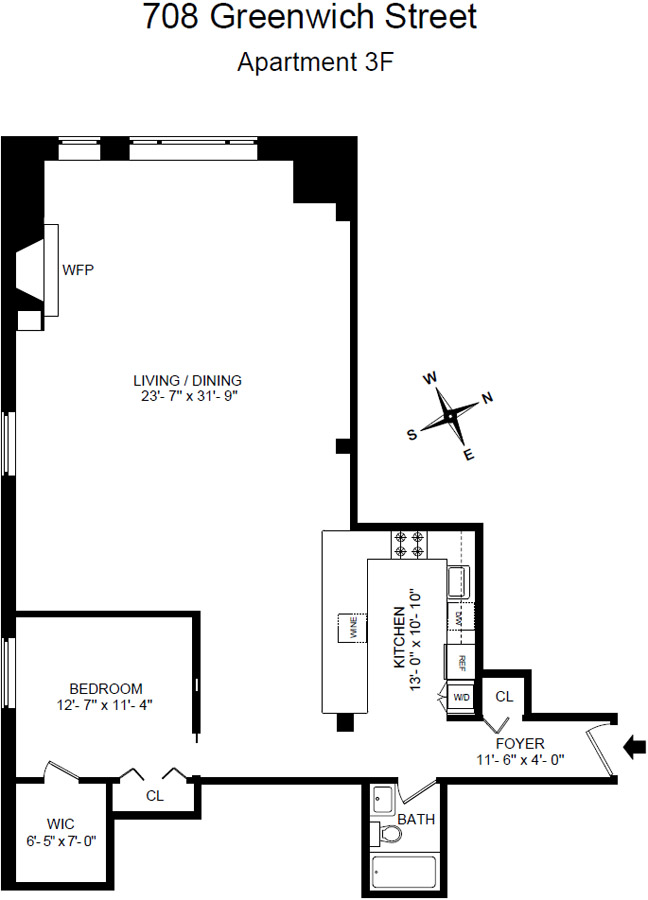

The next visit to Kuhn’s building by Manhattan Loft Guy considered a partial floor loft, again a project, but by then with some new challenges that go unmentioned by the chanteuse. My December 13, 2011, loft with artist’s personality sells at $1,174/ft at 149 Franklin Street, dealt with a then-recent sale of

loft #5S at 149 Franklin Street that just sold [with] a very idiosyncratic character and a fascinating (odd) floor plan. No one who has seen it was surprised to see that it was the long-time live and work space for an artist, “2,300 sq ft” with a single bedroom, a living room facing Franklin Street, and the rest of the space (that bedroom and the large studio) facing south toward Leonard Street.

Even though only part of the full floor, this south-facing unit, was fairly large (“2,300” of the “3,150 sq ft”), with a still flexible footprint:

The footprint is likely to excite architects: first, note the plumbing stacks, then erase all the walls. There is so much more flexibility with this shape and those window than with the typical 2,300 sq ft Long-and-Narrow. I am a bit surprised (and rather impressed) with the clearing price, given the overwhelming temptation of any buyer to gut the space.

One of the reasons I was impressed with the #5S sale was the comparison to the 3rd floor sales price at The (then) Peak, another reason was a (then, recently sold) condo comp next door, while yet another reason was that the south exposure in this building was (is) very much at risk. See that December 13, 2011 post for details on each of these factors, but especially the development directly south of nearly all of the windows in #5S. That’s the same line of south-facing windows in the 3rd floor floor plan above, and at the far end of the 2nd photo in the Kuhn Slideshow.

a musical building

You’ve seen the New York Times photo of Judy Kuhn sitting and smiling at the Steinway baby grand “that had been in the family for a century” when her parents downsized while she upsized her loft.

Here’s a stand-up piano from the (old) 3rd floor:

(it’s way over on the left wall)

And here’s another grand from the (former) loft #6S owner, who sold for $2.775m on December 17, 2013:

looks like a full grand to me

That’s a lot of pianos for a 7-unit building. And it’s not even The Juilliard Building, one block south. One that … er … note, I will stop ….

Follow Us!