were feet in larger loft at 105 East 16 Street worth more than in smaller loft?

Conventional Wisdom about Manhattan residential real estate is right, often

I don’t know if the equation “1 + 1 = 2.5” is original to The Miller, but he is my source for it. What he means is that in the current residential real estate market in Manhattan (and for some time past) a square foot in a larger space is worth more than a square foot in a smaller space because it is in a larger space. The fun application of this CW is that the same square foot in a smaller space becomes more valuable by being combined into a larger space. As if by wizardry! Skeptic that I am, I like to test CW (even if from The Miller), as in my September 10, 2011, deconstructing NY Times article about combining apartments to increase value, and soon thereafter in my November 11, 2011, did 30 West 15 Street lofts sell at premium due to combination potential? (hint: no premium found for a combination purchase). With the assumptions and guessing stated below, it appears that the sale on January 22 of the “4,000 sq ft” Manhattan loft on the 5th floor at 105 East 16 Street for $5.125mm is, at best, a mild example of this CW, in this case establishing suggesting that 1 + 1 = 2.11.

Let’s look at the 5th floor loft, then do the math.

not everyone would break up a “4,000 sq ft” loft like this

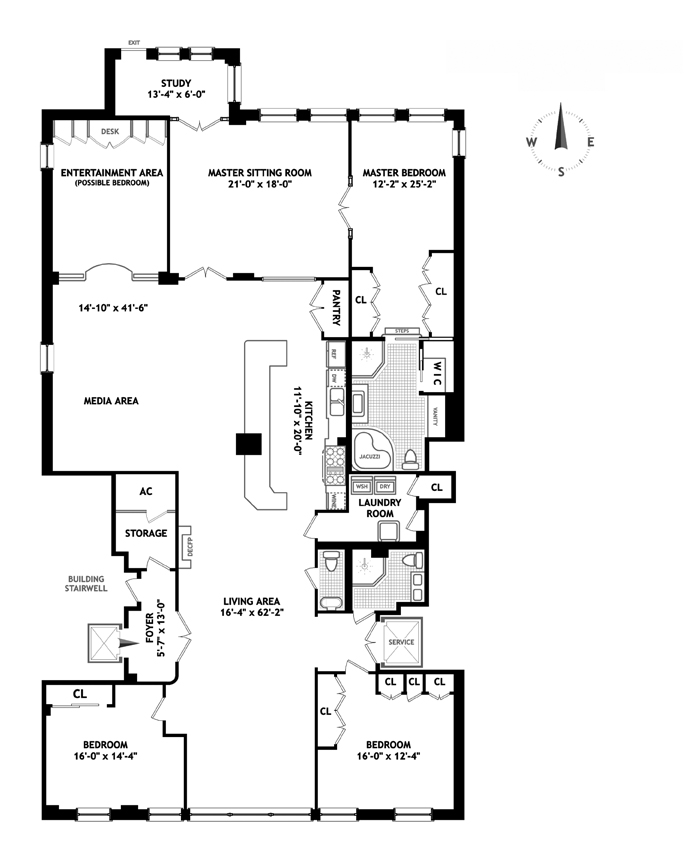

The loft takes up the entire 5th floor and has only three bedrooms and 2.5 baths. (“Only” only make sense when you consider it is said to be 4,000 sq ft.) I understand the logic of the layout (the master suite is as far from the purple princess bedroom and the lair of the twin superheroes as it could possibly be); and I understand the allocation of extravagant space to the masters of the loft: a sitting room bigger than your bedroom, a large master bedroom proper, a master bath bigger than the two baths in your home, and a study off that sitting room. There’s room for a media room and an “entertainment area” (4th bedroom candidate, for sure), but — for such a massive space — a surprising lack of volume, if the photos accurately represent the space. Likely, it’s the choice to leave only three of the “17 large windows” for the living room.

every room is over-sized, except for the living room (interesting choice, that)

With 12 foot ceilings, maybe this looks bigger in real life:

you wouldn’t guess this was the living room of a “4,000 sq ft” loft

The great room (really, the remainder of the space after the corner rooms and kitchen are taken out) is 16 feet wide, but is pinched by the passenger and freight elevator access points, with a dining table to one side and piano and seating in front of the windows.

The kitchen gets some quality broker babbling, but I wonder about its appeal for loft lovers, being more country house than industrial:

suburban, maybe, or country; not especiallly loft-y (huge, certainly)

The baths get no photos, so I wonder how dated they are, with that jacuzzi.

The loft sold for $1,281/ft, which obviously disappointed the sellers:

| June 20, 2014 | new to market | $5.95mm |

| Sept 8 | $5.495mm | |

| Nov 17 | $5.25mm | |

| Dec 1 | contract | |

| Jan 22, 2015 | sold | $5.125mm |

That’s only 14% off the first ask, but at this level that’s $825,000. And nearly six months to contract, when these sellers were probably reading about $5mm sales left and right. And remember: $1,281/ft. That’s a below median price per foot for lofts sold in 2015 and recorded on my Master List of downtown loft sales (based on a quick count). hard to find room in that price for a premium for anything, large size included.

downstairs, irony abounds

The folks who sold the “1,850 sq ft” loft #3N weren’t wrong to describe their master suite as “oversized”, it’s just that in comparison to the 5th floor … well, comparisons are unfair. This smaller loft has a more loft-y kitchen and a floor plan optimized as a One Bed Wonder, but it can be tinkered with to create nearly the utility of the 5th floor (well, 3 bedrooms, 2 baths, if not “4,000 sq ft” with an entertainment room and media room and …).

clean, modern … loft-y kitchen

seems silly to add those walls north of the kitchen / master wall, but here is the proposal for a 3BR (2BR + dark guest room)

The finishes get a similar level of babbling as with the 5th floor, with a bit of specific bragging about the bathrooms, so I’d guess the two lofts are in similar condition. If so, the only adjustment needed to comp A Big Loft at 105 East 16 Street against A Small (well, moderate) Loft is time, which is easy enough (in theory, of course). In theory, we can start with the observed #3N value in August 2013 of $1,005/ft, then add the 15% by which the StreetEasy Manhattan Condo Index is up by the time the 5th floor sold. That adjusted $1,157/ft is disappointing to fans of 1 + 1 = 2.5.

With the small loft (adjusted) at $1,157/ft and the huge loft at an observed $1,281/ft, there’s either a problem with the comp analysis or the Conventional Wisdom wasn’t quite conventional enough to apply here. (It’s quite possible the ball parking involved in comping these two lofts, sight unseen, by extrapolating from the StreetEasy Index, is too rough.) But the result is more like 1 + 1 = 2.11 than 1 + 1 = 2.5.

To be fair, what The Miller said in the New York Times piece from September 2011 was not exactly an arithmetic fact of 1 + 1 = 2.5; instead, he said

it’s not uncommon to see a 20 percent premium on a price-per-square-foot basis

In italics, sometimes (not usually, or often), and (in those some times) as much as 20% above the price-per-square-foot value of “1” alone. Sometimes you get your 1 + 1 = 2.5, sometimes you get a ‘premium’ that could as well be a function of market noise on one or both sides of a pair of comps.

To repeat myself from 2011: I don’t doubt that there are examples of 1 + 1 = 2.5, it’s just that I can’t say I’ve ever actually seen one. And the reason I don’t doubt that there are such rare beauties out there is that the market logic is unassailable: there are (still!) relatively few 3+ bedroom spaces for sale, so huge spaces can be bid up by a supply-demand imbalance. I’ll keep looking….

lifting the kimono on the Media Division of the Manhattan Real Estate Industrial Complex can be disappointing

I’m glad I looked back at my September 10, 2011 post, as it brought back this rumination about why articles such as the NY Times piece featured tend to talk about General Principles using currently available for-sale listings (suffering from the problem of being not-yet-established as market values, as well as from the problem of the sources tending to be people trying to sell these things), instead of, well, actual data points of closed sales.

Bear with me for this long self-quote, as valid now as it was then:

But my basic response to the article started with “sheesh … that’s not very helpful without real past examples”, which led to “why aren’t there real past examples”, which morphed into “no one with the data is motivated to find real past examples”, as the role of the New York Times in the Real Estate Industrial Complex came into focus for me. (Again, this may be obvious to serious fans of Manhattan real estate, but it did not coalesce for me in this way until today.)

Vivian Toy (or any other reporter) does not know where the real life examples are, but maybe she could find some with a great deal of effort. The developers and sales agents for new developments know, but that is not what they really want to talk about. The sales agents with one-off combo listings might or might not know, but that is not what they really want to talk about.

So, in exchange for getting good quotes about the general topic from people who know (or might know), Toy let’s them talk about what they really want to talk about: the currently available listings that offer the potential to combine units to make 2.5. Would it have been rude for her to ask about past examples, to see if the “somewhat mystifying” math can actually be observed in the real world, even if the professionals are principally interested in selling their inventory and only secondarily (if at all) interested in educating the populace? You know, as in a more even exchange of back-scratching than Toy played.

Feel free to apply this test for any article you see about Manhattan real estate principles: the examples tend to be currently offered for sale (with no established market value) and the speakers tend to be people with stuff to sell (and The Miller, then as always the go-to guy for a balanced and informed view).

Look for the Trends & Data section of the StreetEasy blog to try to break this pattern by offering Big Data. I especially liked their use in a March 10 post of past sales data and contract dates to address market seasonality and key-words for brokers to babble.

Follow Us!