no rational market evident in 708 Greenwich Street loft sale $260k over ask

an ‘efficient’ Manhattan loft market requires more transparency than a bidding war can offer

From November 2014 to February 2015 the overall Manhattan residential real estate market was essentially flat, unless you consider a change of .01% to be a significant deviation from the horizontal. (That’s per the best single number proxy for ‘the market’ that I am aware of, the StreetEasy Manhattan Condo Index, which went from 241.00 to 243.76 in that period.) From November 2014 to February 2015 the asking price for the “1,360 sq ft” Manhattan loft #3F at 708 Greenwich Street deep in the West Village went from $2,388,888 (November 11) to $2,249,000 (January 8) to $1,999,999 (February 23). The Market had two months to decide that it didn’t like that first asking price and six weeks to decide that it didn’t like the second, but it took only two weeks to like the third price. (Hold that thought….)

In the four months from that November 11 entry to the market and the March 10 contract, there were about 160 downtown Manhattan lofts that closed that had sufficiently rich data to calculate days on market (per my Master List); 39 of the about-160 went to contract within 30 days (in Red on the Master List) and another 29 within 60 days, compared to 119 days for loft #3F. You’d think from this litany that #3F was a bit of a laggard, rather long on the market and with the two price drops. This being Manhattan Loft Guy, and you already having a hint in the title, however, you won’t be too surprised to learn that the loft went to contract on March 10 (after those 119 days) above ask.

If you clicked on either the listing link or the Master List link you won’t be as surprised as I was to note that loft #3F sold for $2.26m. That’s a healthy 13% premium to the last ask and a head-scratching $11,000 over the middle ask (only a half a percent, but that’s not the point). It seems obvious that someone could have bought this loft for $2.249mm from January 8 (a little earlier, even) to whenever the two potential buyers collided in late February or early March.

That may not burn the successful bidder (who only paid 0.5% over the middle ask, after all) but it might burn the unsuccessful bidder who lost the bidding war over the $1,999,999 ask. And it should really burn fans of efficient markets.

To repeat some market ‘facts’, in reverse:

- the market value of loft #3F was $2.26mm on March 10 (d’oh! that was the price agreed to by a willing seller and a willing buyer, neither under compulsion)

- the market value of loft #3F was less than $2.249mm for a non-trivial number of weeks from (probably) late December until (probably) late February (d’oh! they were asking; there were no takers)

- the market value of loft #3F was less than $2.4mm for the last two months of 2014 (d’oh! they were asking; there were no takers)

- it took 119 days for loft #3F to find a contract within 5% of its original asking price, an asking price that demonstrably failed to attract an acceptable offer for two months

(head … hurts ….)

meanwhile, back in the loft …

Not surprising, for a coop loft that sold for $1,661/ft, loft #3F has a lot of charms. A renovation babbled as “stunning” (with a chef in the kitchen and a rain shower in the bath), ceiling heights as “enormous”, details as “original” (with massive wood beams, columns and capitals), even a washer-dryer and a fireplace. The coop has some useful amenities (roof deck, bike room) and a live-in super.

the best angle, with the most charms

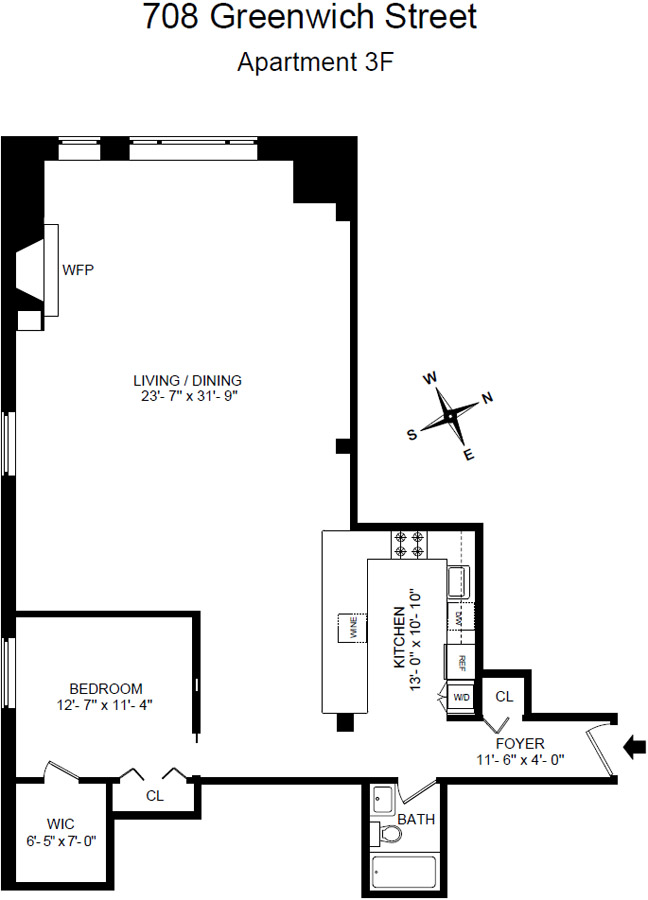

What the loft does not have: (much) private space, with a single bedroom and a single bath. Of course you could add a second bedroom, but that would ruin the sense of space from the kitchen and dramatically shrink the great room:

a 2nd BR would eat that other S window, and there’s no place to add a bathroom, I guess, without really shrinking the kitchen

This space isn’t large enough to be a true Manhattan Loft Guy One Bed Wonder, but it is clearly optimized for what it is: a lovely space for however many people sleep in that one room, who can enjoy the “over 1,000 sq ft of generous living space with soaring ceilings and two exposures”, who like to cook (a huge kitchen, proportionately) and entertain (on the roof, if the two exposures aren’t enough inside).

So I can see why it was popular enough to attract two bidders. I have more trouble seeing why it did not sell earlier than it did. But I shouldn’t quibble….

Follow Us!