challenging 474 Greenwich Street loft proves a challenging sale, not quite $2 million off

location, decor, layout … let me count the Tribeca loft challenges (and price!)

I won’t say I was proud of it, but my first reaction on seeing the “2,300 sq ft” Manhattan loft #4S at 474 Greenwich Street being offered for sale a million years ago in November 2013 for $4.75mm was to (yes) Laugh Out Loud. Begging pardon for being rude, but I could see a few things about that loft at that time: it had not sold for two months in 2011 when it was available for $3mm and $2.5mm; and it had not sold for three months 2012 when it was available for $2.175mm. (I’m pretty sure I had seen it with buyers in either 2011 or 2012, either that or the photos had left such an imprint in my Loft Brain that it was as though I had seen it.)

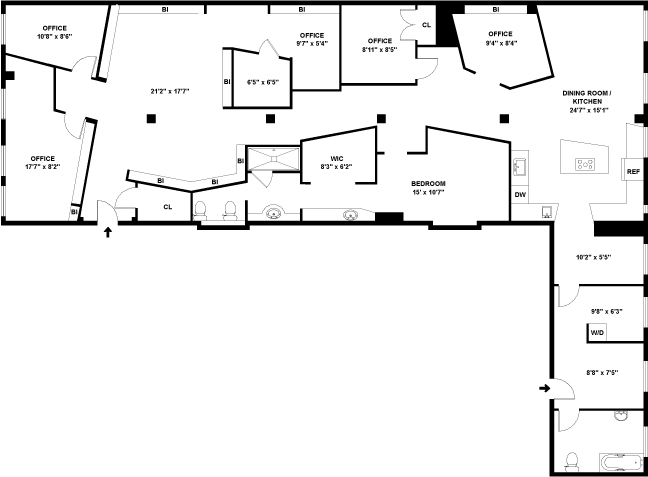

Here’s what I could not see when it came back to market in November 2013 at $4.75mm; any change in the loft other than (perhaps) the removal of some of the walls that made it a rabbit warren in 2012 and 2011. If, in fact, those walls had come down, that exercise demonstrated that (as the broker babble babbles) “the possibilities for this massive space are endless!”. The listing photos are maddeningly difficult to read against the floor plan, but the thrust is simple: this is a loft with classic elements like exposed brick, wide oak plank floors, wood columns, and high beamed ceilings, along with open views and a very large, very elaborately tricked out kitchen. As implied by “endless possibilities” babbling, buyers were invited to consider how to remake the space from the single-bedroom live/work space that it is. That invitation, in particular, induced my rude response to the initial 2013 asking price.

Well, that and the colors and the decor, which strike me as pummeling a buyer into a glaze. The last marketing efforts were only the third in a sequence of presentations that showed this loft interior as extremely busy. If the floor plan really does have this vast great big open space, wouldn’t you expect to see a photo of that volume??

that north wall plumbing / closet bump is the only thing that closes off any part of the larger rectangle (2,067 sq ft??)

I don’t see any hint of that huge room, with the east wall of windows, in any of the listing photos. With all the zigging and zagging in the photos, the place looks like it could still be this (circa 2012):

this is what can happen to a loft when you have a carpenter in the family and access to materials at a discount (that, and the need for 1, 2, 3, 4 … 5 offices)

Bottom line: they’re not bragging about anything other than bones, view and kitchen, and they’re selling the “possibilities”, so this is a renovation project for nearly every buyer, of varying scale. That’s one challenge.

Another challenge: the loft sits about as far north as you can get without leaving Tribeca. (The StreetEasy map on the listing page proves this at an almost comical level, at the zoom / scale at which the graphic originally appears.) In proper babbling, that’s “just steps away from some the best restaurants, public transportation, that Tribeca, SoHo and the West Village have to offer”, even without being particularly close to any of them.

The big challenge, of course, was the price. LOL

a long marketing history, thankfully concluded three weeks ago, off just a bit

Let’s do this in one table:

| Aug 16, 2011 | new to market | $3mm |

| Sept 2 | $2.5mm | |

| Oct 17 | off the market | |

| May 19, 2012 | change firms | $2.175mm |

| Aug 8 | off the market | |

| Nov 13, 2013* | change firms | $4.75mm |

| April 4, 2014 | hiatus | |

| May 19 | back on market | $3.5mm |

| Aug 11 | $2.995mm | |

| Oct 30 | contract | |

| Jan 23, 2015 | sold | $2.95mm |

(*details in the last marketing history that are different from StreetEasy are from the inter-firm data-base)

Even without the scale, this is a fascinating history. The seller seems to a have been unmotivated, with those two stabs at the market in 2011 and 2012. That pricing trend was positive, at least insofar as it reacted to the lack of success. For reference to the overall market (meaning the StreetEasy Condo Index, my preferred proxy for movement in the overall Manhattan residential real estate market), the overall market increased 29% between the time loft #4S left the market while asking $2.5mm and its eventual sale, and 26% between the time it left the market asking $2.175mm and its eventual sale.

One implication is that the loft would have sold at $2.175mm or above, had it simply hung around longer in 2012 for enough buyers to get exposed to it. Another implication is that even the final 2011 price might also have worked (in the sense of “worked” as provoking a bid at the market), if given enough time.

Another implication of this kind of retrospective ‘reasoning’, however, is that such attempts to apply later-determined market values to unsuccessful asking prices are … difficult, if not silly.

Silly is a nice segue into my rude response to this: $4.75mm, which proved its futility over five months. Wouldn’t you like to have been a fly on the wall when the seller agreed to come back to market at $3.5mm without changing firms for a third time? Of course, even that 7-figure drop was still a half-million dollar stretch from the market value, though a step in the right direction. The bottom line of $2.95mm works out to $1,282/ft, not a very Tribeca-like value, even for a low-frills coop (common roof deck and storage move this from no- to -low-frills). But: it sold 38% off the first, fanciful ask. Just kidding?? Nah ….

Follow Us!