replacing nude woman with a slut sells Village loft at 12 East 12 Street at $1,806/ft

well, that, a few discounts, + 18 months

Sergeant Joe Friday would ask only about the asking prices and timing of the “2,750 sq ft” Manhattan loft #3S at 12 East 12 Street on the Gold Coast of Greenwich Village; others would consider the decor as a factor in the eventual sale of this lovely loft. First we’ll give Joe his facts, ma’am, and then we’ll consider art and offense:

| May 20, 2013 | new to market | $5.75mm |

| Sept 9 | $5.65mm | |

| Nov 5 | $5.225mm | |

| June 30, 2014 | hiatus | |

| Sept 4 | change firms | $4.995mm |

| Nov 10 | contract | |

| March 11, 2015 | sold | $4.995mm |

(note that there were no off-market gaps in our listing system, contrary to StreetEasy’s history)

That’s 16 months of active marketing to get to contract and 22 months until “sold”, overall, but only 3 price drops. An outsider never knows who was pushing the pricing strategy, as between the sellers and their agents, but they were clearly wrong for 13 months. Then right. There is no “marketing strategy” so right as being at a price that will attract a buyer, but there were some non-monetary changes that make me curious about strategy.

what do ‘they’ say about idiosyncratic decor? about ‘offensive’ art??

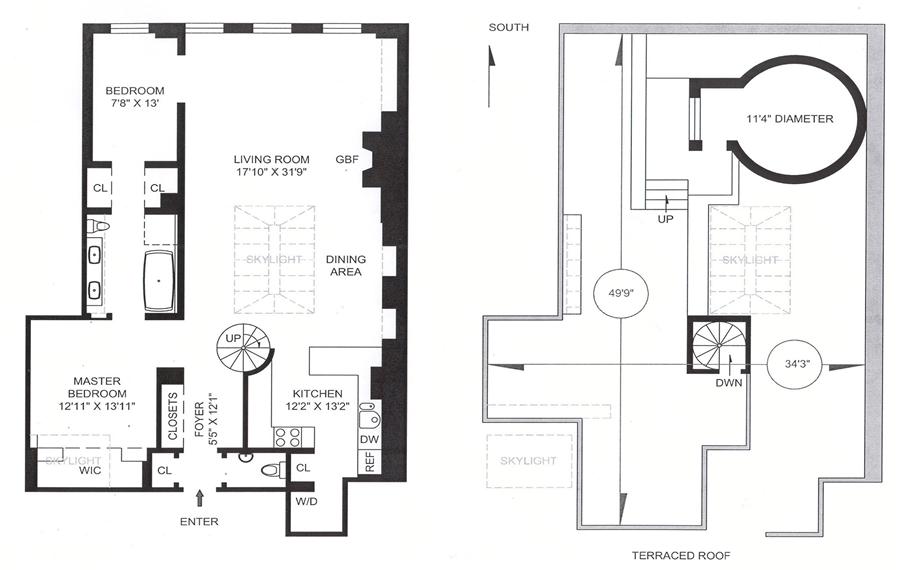

The loft is essentially square, with the unfortunate twist of a single exposure. A rather large space, it is optimized for a single person or couple, with but one (legal) bedroom and a (dark) guest room stuck in the northwest corner.

great place to live, if you only have “guests”

Nothing says ‘grown-up loft’ quite like a Wine ‘Cave’ as big as some kid rooms, right? Whether a dark and textured master suite is grown-up or not, it is idiosyncratic, and (as we all know) idiosyncratic design choices can shrink a buyer pool. While this is just ‘skin’, some people can’t see past it:

a curiously bare floor, what with all the other busy-ness

Artwork can also be gown-up. And idiosyncratic. The piece on the dining room wall is sufficiently idiosyncratic that I (who know little about Art) had to think that “Tulsa slut” meant something.

(it can be hard to read at this scale + resolution, but that’s T U L S A S L U T)

The blue and yellow (print? canvas?) has to be a variation of a word-painting at MoMA. Just don’t ask me what it means. Now, it’s not likely that anyone interested in a grown-up loft would be offended by this art, but what struck me is that in the over-priced period for this loft there was a very different piece of art in this location. From the 2013-14 listing:

yeah, that’s a naked woman

You can see it better in pic #4 from the StreetEasy listing from 2013 (which I cannot embed, alas). For all I know, both the 2013 naked dining room piece and the Tulsa Slut piece are highly acclaimed and very valuable pieces of art Art. What caught my eye is that the one replaced the other. Maybe that was an Art Transaction, or a rotation of collection. Or maybe someone considered whether the loft was more sale-able (more easy to relate to) with the word art instead of the naked art.

Of course, I have no idea what the sellers were thinking throughout. And it is much more likely that the loft didn’t sell in 2013 or (earlier) in 2014 because the price was too high. But I find the change in art curious….

not much like it in the building

The Past Activity tab on the StreetEasy building page indicates the variety of loft sizes in this 26-unit 12-story condo, converted in 1982, with lofts as small as “800 sq ft” or “1,000 sq ft” and full floor lofts at either “5,600 sq ft” or “6,000 sq ft” (at least one “measurement” in each pair must be wrong, and the “800 sq ft” loft might also be “1,100 sq ft”, but don’t get me [re-] started on that). In a building with such scale variations, even internal comps are difficult to apply. Worse for the #3S sellers and agents, while loft #3S was offered for sale only two neighboring lofts sold, both without public marketing (the small #7NE in June 2014 at $954/ft in what looks like a distressed sale, and the “1,760 sq ft” loft #1C in September 2013 at $1,250/ft).

Prior to #3S coming out at $2,091/ft, the “1,725 sq ft” loft #2NW had just sold in March 2013 at (only!) $811/ft in a sale I hit in my April 12, 2013, 400 shoes that used to live in 12 East 12 Street loft need a new home, carry big profit (the second time I blogged about the same loft and the same shoes [see my November 7, 2010, another loft in New York Times, another inexpensive renovation, with 400 shoes]), and the seemingly comparable “2,790 sq ft” loft #12SW had sold in December 2012 at $1,252/ft. I can easily see ignoring the #2NW sale as not comparable to #3S because of size. The #12SW sale is more difficult to apply for many reasons.

First, it is clearly not anywhere near “2,790 sq ft”, as StreetEasy has it. Even with the disclaimer about floor plan measurements (blah, blah, blah), you can’t get near even 2,000 living feet from this plan:

with max length about 45 ft + max width about 32 ft, that’s less than 1,500 before counting the circle upstairs

(I wonder if StreetEasy counted the 12th floor interior and the essentially identical-in-size roof level; that could be 2,790 sq ft, in fact, even though no one includes exterior space in that manner. Arggghhhh) And then there’s that roof terrace to adjust for, once you got confident about the interior size. Not to mention (he said, mentioning) the “stunning” views and light from the top floor of the building, including from the skylights, or the finishes (“meticulously designed” doesn’t necessarily mean a no-detail-spared renovation, but #12SW does look pretty sweet), or the fact that the stairway kills space. For fun, we could call the adjusted size about 2,100 sq ft (valuing the terrace at 50% of the interior), yielding an implied adjusted value for #12SW of about $1,664/ft.

Nope, this December 2012 sale would have been a difficult comp to apply to #3S when the sellers brought it to market five months later. Still, $2091/ft in May 2013 was many dollars off. As was $2,054/ft in September 2013. And $1,900/ft in November 2013 (and for another six months).

The right asking price in November 2014, however, was so clearly right that the loft closed for that $1,816/ft when it sold last month.

playing with numbers is fun, when the numbers represent the dollars of others

To bring this to a close, let’s see what the #12SW sale from December 2012 at an adjusted $1,664/ft looks like in March 2015 terms, using (of course) the StreetEasy Manhattan Condo Index as a single number proxy for the overall Manhattan residential real estate market. The Index is up 27%, suggesting that a ballpark adjusted value for #12SW when #3S sold was about $2,100/ft (if, and this is a huge ‘if’, my guesses about size were correct). That strikes me as a too-large premium for the interior of #12SW, with its better light but (likely) no better condition, even with me ignoring the third floor balcony. Bump the value of the #12SW terrace to par with the interior, and we get down to $1,252/ft in December 2012, and $1,590/ft as of the #3S sale … oops, too low. But an adjustment based on the roof terrace being worth 75% of the interior gets #12SW to $1,458/ft (then) and $1,852/ft (now).

On the one hand, ball parking #12SW now at $1,852/ft compared to the in-real-life observed $1,816/ft for #3S seems very close to perfect. On the other hand, backwards reasoning like this looks like playing more with a shoehorn than with reason. But we are just playing here. Unlike the real world sellers and agents for #3S, who were dealing with hard dollars.

Did I mention (recently) that comping is hard?

If only they’d have known in May 2013 that The Market would value #3S as worth not-quite what #12SW was worth, with the exterior of #12SW being worth 75% of the interior…. (Just kidding: comping is hard enough in retrospect, and even more difficult in real time.)

Follow Us!